San Diego Real Estate Sales Activity for August 2014 Snapshot

- + 1.8% – One-Year Change in Pending Sales

- – 23.7% – One-Year Change in Closed Sales

- + 8.3% – One-Year Change in Median Sales Price

- – 4.8% – One-Year Change in Homes for Sale Inventory

- – 6.5% – One-Year Change in New Listings Inventory

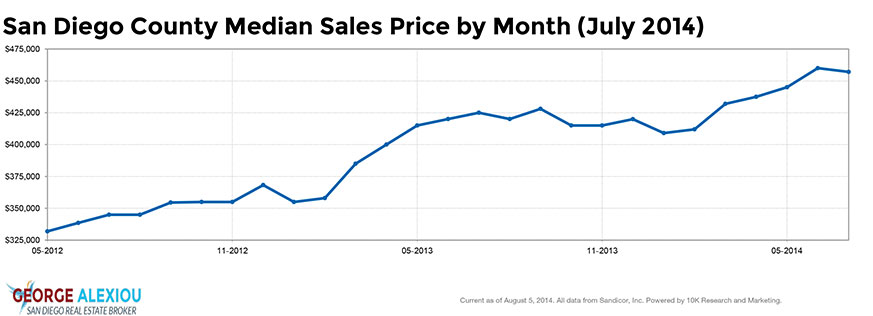

Housing had a slow start to the year but ongoing market improvements across various areas and segments continue. Nowadays, it’s important to assess market performance by price point. Also watch for long-awaited and yet still-uneven inventory gains. For the 12-month period spanning September 2013 through August 2014, Pending Sales in San Diego County were down 8.9 percent overall. The price range with the largest gain in sales was the $1,000,001 to $1,250,000 range, where they increased 16.6 percent.

Quick Facts

- + 16.6% – Price Range With Strongest Pending Sales: $1,000,001 to $1,250,000

- – 6.7% – Home Size With Strongest Pending Sales: 1,501 Sq Ft to 2,000 Sq Ft

- – 4.4% – Property Type With Strongest Pending Sales: Condos – Townhomes

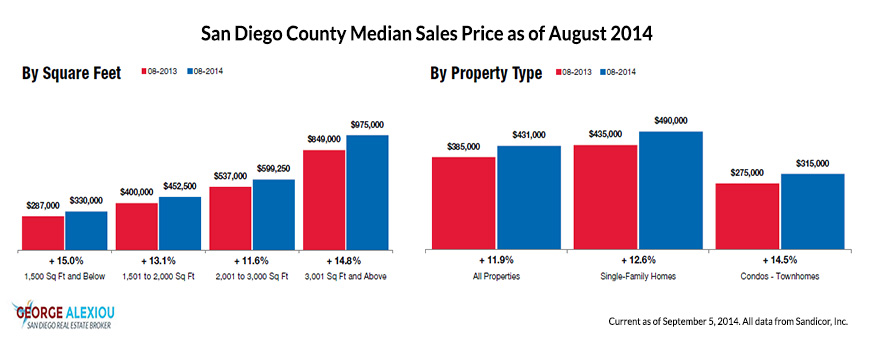

The overall Median Sales Price was up 11.9 percent to $431,000. The property type with the largest price gain was the Condos – Townhomes segment, where prices increased 14.5 percent to $315,000. The price range that tended to sell the quickest was the $500,001 to $750,000 range at 37 days; the price range that tended to sell the slowest was the $1,250,001 Or More range at 68 days.

Market-wide, inventory levels were down 4.8 percent. The property type that lost the least inventory was the Single-Family Homes segment, where it decreased 4.1 percent. That amounts to 3.5 months supply for Single-Family Homes and 3.0 months supply for Condos – Townhomes.

New Listings decreased 6.5 percent to 4,306. Pending Sales were up 1.8 percent to 3,076. Inventory levels shrank 4.8 percent to 9,460 units.

Prices continued to gain traction. The Median Sales Price increased 8.3 percent to $455,000. Days on Market was up 5.1 percent to 41 days. Buyers felt empowered as Months Supply of Inventory was up 6.3 percent to 3.4 months.

Sustained job growth, lower mortgage rates and a slow rise in the number of homes for sale appear to have unleashed at least some pent-up demand. Since housing demand relies heavily on an economy churning out good jobs, it’s encouraging to see second quarter GDP growth revised upwards to a 4.2 percent annualized rate and stronger than expected job growth in recent months. Further improvements are still needed by way of wage growth and consumer confidence but recovery continues.

Residential real estate activity in San Diego County, comprised of single family properties, townhomes and condominiums. Percent changes are calculated using rounded figures.

Source: San Diego Association of REALTORS® – All data from Sandicor, Inc.