San Diego Real Estate Sales Activity for July 2014 Snapshot

- – 3.6% – One-Year Change in Pending Sales

- – 23.4% – One-Year Change in Closed Sales

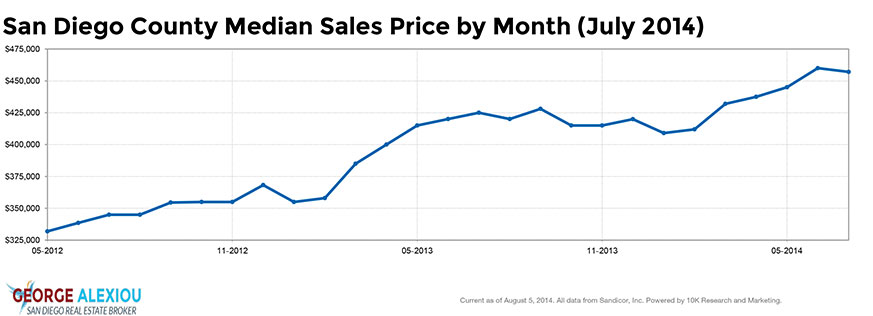

- + 7.5% – One-Year Change in Median Sales Price

- – 0.4% – One-Year Change in Homes for Sale Inventory

- + 3.7% – One-Year Change in New Listings Inventory

Some claim that housing has stalled. The truth is that price recovery has simply outpaced comparable wage growth, which is a short-term challenge. With tight inventory and tight credit, further economic gains are needed in order for housing to regain some traction. It appears that some of those gains may have arrived in the form of better-than-expected second quarter growth. For the 12-month period spanning August 2013 through July 2014, Pending Sales in San Diego County were down 9.1 percent overall. The price range with the largest gain in sales was the $1,000,001 to $1,250,000 range, where they increased 18.8 percent.

Quick Facts

- + 18.8% – Price Range With Strongest Pending Sales: $1,000,001 to $1,250,000

- – 6.0% – Home Size With Strongest Pending Sales: 1,501 Sq Ft to 2,000 Sq Ft

- – 4.4% – Property Type With Strongest Pending Sales: Condos – Townhomes

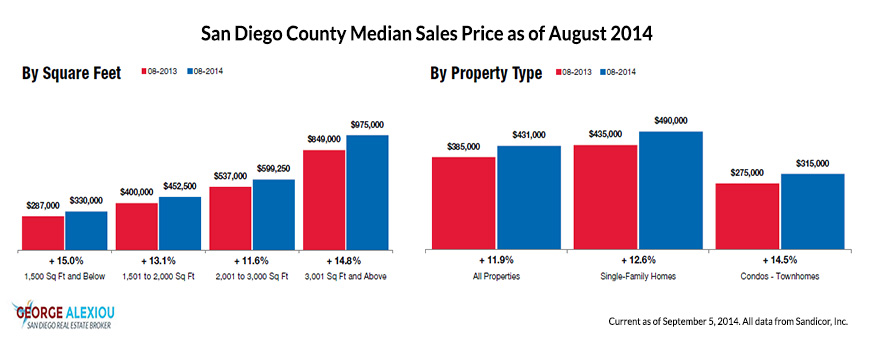

The overall Median Sales Price was up 13.1 percent to $429,900. The property type with the largest price gain was the Condos – Townhomes segment, where prices increased 15.5 percent to $311,900. The price range that tended to sell the quickest was the $500,001 to $750,000 range at 37 days; the price range that tended to sell the slowest was the $1,250,001 Or More range at 68 days.

Market-wide, inventory levels were down 0.4 percent. The property type that lost the least inventory was the Single-Family Homes segment, where it decreased 0.2 percent. That amounts to 3.5 months supply for Single-Family Homes and 3.0 months supply for Condos – Townhomes.

New Listings increased 3.7 percent to 4,944. Pending Sales were down 3.6 percent to 3,183. Inventory levels shrank 0.4 percent to 9,458 units.

Prices forged onward. The Median Sales Price increased 7.5 percent to $456,995. Days on Market remained flat at 39 days. Absorption rates slowed as Months Supply of Inventory was up 6.5 percent to 3.3 months.

The U.S. Department of Commerce reported that GDP grew at a 4.0 percent annual rate in the second quarter and that the first quarter was less bad than previously thought. Consumer spending in the first quarter rose 2.5 percent, which is encouragingly in tandem with savings rates. Increased consumer spending means more demand for goods and labor; increased savings rates means more resources for down payment. With rates still low, rents still rising and private job growth accelerating, it’s becoming more and more difficult to side with the housing perma-bears.

Residential real estate activity in San Diego County, comprised of single family properties, townhomes and condominiums. Percent changes are calculated using rounded figures.

Source: San Diego Association of REALTORS® – All data from Sandicor, Inc.