San Diego Real Estate Sales Activity for April 2015 Snapshot

- + 0.1% – One-Year Change in Pending Sales

- – 2.0% – One-Year Change in Closed Sales

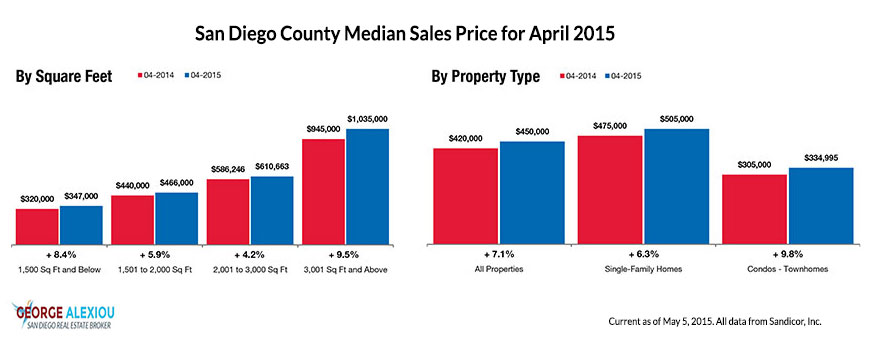

- + 7.1% – One-Year Change in Median Sales Price

- – 13.0% – One-Year Change in Homes for Sale Inventory

- + 1.6% – One-Year Change in New Listings Inventory

As we journey into the traditional selling season, there is great evidence of bustle. Lenders and REALTORS® are working vigorously to keep up with the demand of eager buyers lining up three deep. Meanwhile, the desire for more inventory continues. For the 12-month period spanning May 2014 through April 2015, Pending Sales in San Diego County were up 0.1 percent overall. The price range with the largest gain in sales was the $1,250,001 or More range, where they increased 17.4 percent.

Quick Facts

- + 17.4% – Price Range With Strongest Pending Sales: $1,250,001 and Above

- + 3.4% – Home Size With Strongest Pending Sales: 1,501 Sq Ft to 2,000 Sq Ft

- – 0.4% – Property Type With Strongest Pending Sales: Single-Family Homes

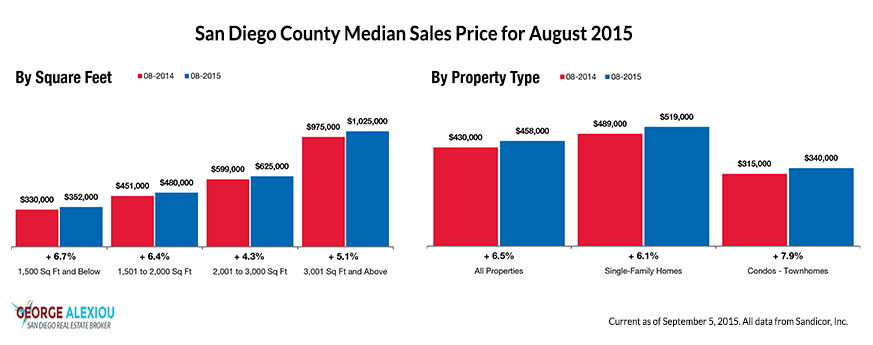

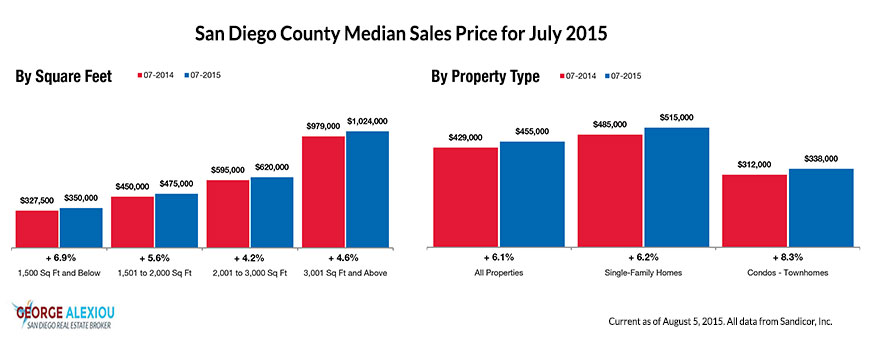

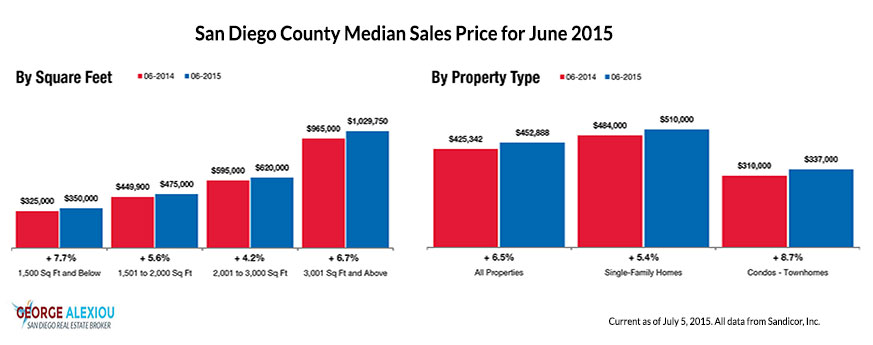

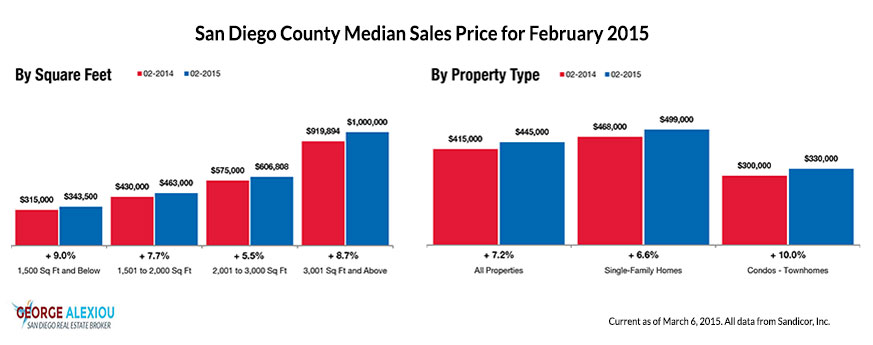

The overall Median Sales Price was up 7.1 percent to $450,000. The property type with the largest price gain was the Condos – Townhomes segment, where prices increased 9.8 percent to $334,995. The price range that tended to sell the quickest was the $500,001 to $750,000 range at 40 days; the price range that tended to sell the slowest was the $1,250,001 or more range at 66 days.

Market-wide, inventory levels were down 13.0 percent. The property type that lost the least inventory was the Single-Family Homes segment, where it decreased 12.4 percent. That amounts to 2.6 months supply for Single-Family Homes and 2.2 months supply for Condos – Townhomes.

As we turn the page to the second quarter of 2015, a proliferation of new listings is expected in most markets across the U.S. Spring is traditionally the commonplace time of the year that we see some of the most desirable gems polished for eager buyers. Though some Google searches and Twitter posts will blatantly offer pessimism about the state of the housing market, on-the-street evidence does not support bad tidings.

Closed Sales increased 1.1 percent for Detached homes but decreased 8.0 percent for Attached homes. Pending Sales increased 14.5 percent for Detached homes and 22.3 percent for Attached homes. Inventory decreased 12.4 percent for Detached homes and 14.3 percent for Attached homes.

The Median Sales Price was up 6.3 percent to $520,000 for Detached homes and 4.3 percent to $344,250 for Attached homes. Days on Market decreased 12.8 percent for Detached homes and 7.3 percent for Attached homes. Supply decreased 13.3 percent for Detached homes and 15.4 percent for Attached homes.

The national homeownership percentage is the lowest since 1993, when Jurassic Park was the highest-grossing movie. Rental prices continue to astonish with accelerated price growth, which may cause some to think twice before locking in a 12-month lease. Lending practices and mortgage rates will also have a decided effect on the number of buyers who will become

homeowners this year. With the release of Jurassic World this month, we are reminded of cyclical conversations in both real estate and moviemaking.

Residential real estate activity in San Diego County, comprised of single family properties, townhomes and condominiums. Percent changes are calculated using rounded figures.

Source: San Diego Association of REALTORS® – All data from Sandicor, Inc.