San Diego Real Estate Sales Activity for May 2015 Snapshot

- + 2.9% – One-Year Change in Pending Sales

- – 3.7% – One-Year Change in Closed Sales

- + 5.9% – One-Year Change in Median Sales Price

- – 16.9% – One-Year Change in Homes for Sale Inventory

- – 5.9% – One-Year Change in New Listings Inventory

The last 12 months have seen a lot of buyer activity. Prices are up in most markets and buyers are hungry to purchase, yet inventory remains low. If existing owners will not sell, new construction is the next best answer to this dilemma. For the 12-month period spanning June 2014 through May 2015, Pending Sales in San Diego County were up 2.9 percent overall. The price range with the largest gain in sales was the $1,250,001 and Above range, where they increased 20.2 percent.

Quick Facts

- + 20.2% – Price Range With Strongest Pending Sales: $1,250,001 and Above

- + 6.4% – Home Size With Strongest Pending Sales: 2,001 Sq Ft to 3,000 Sq Ft

- + 3.0% – Property Type With Strongest Pending Sales: Single-Family Homes

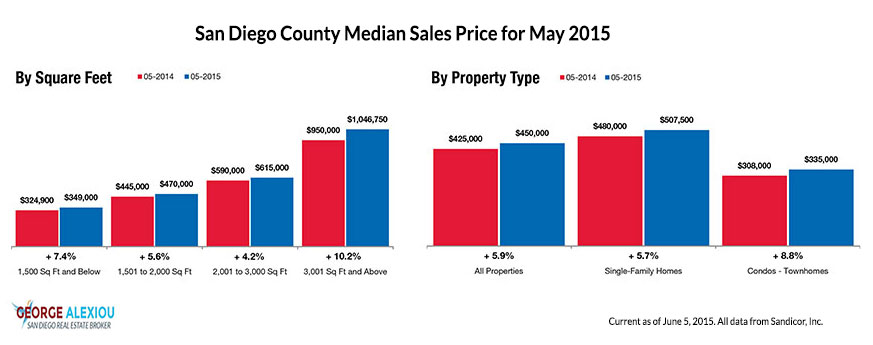

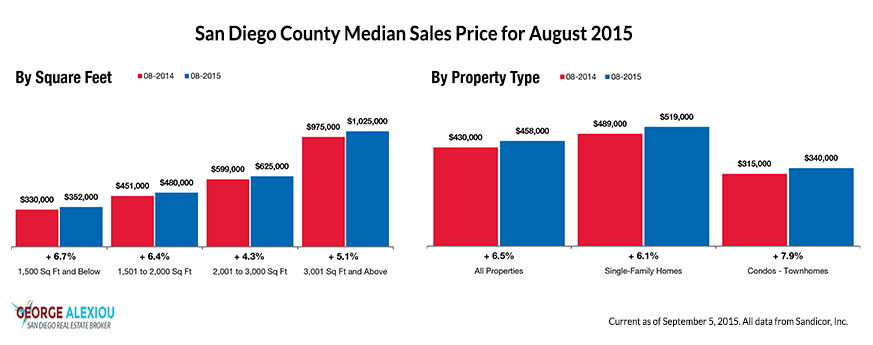

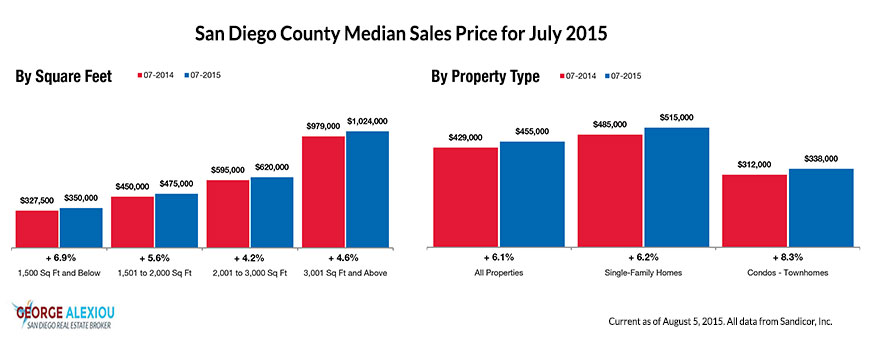

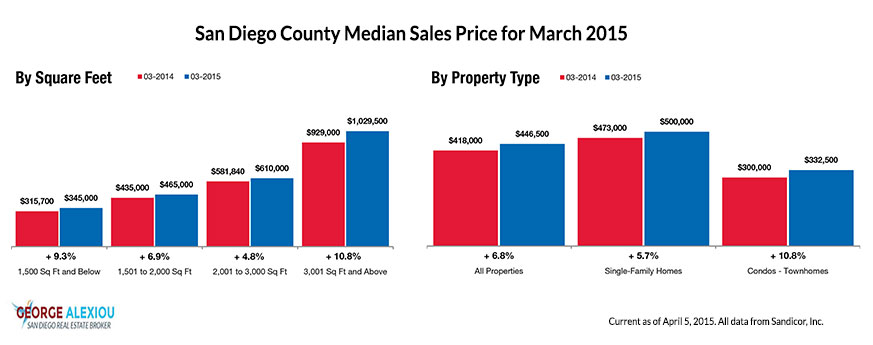

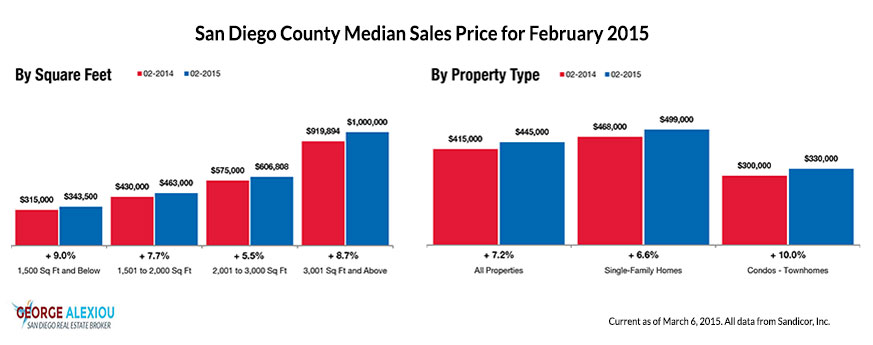

The overall Median Sales Price was up 5.9 percent to $450,000. The property type with the largest price gain was the Condos – Townhomes segment, where prices increased 8.8 percent to $335,000. The price range that tended to sell the quickest was the $500,001 to $750,000 range at 39 days; the price range that tended to sell the slowest was the $1,250,001 and Above range at 66 days.

Market-wide, inventory levels were down 16.9 percent. The property type that lost the least inventory was the Single-Family Homes segment, where it decreased 16.4 percent. That amounts to 2.6 months supply for Single-Family Homes and 2.2 months supply for Condos – Townhomes.

The U.S. economy has been pretty even so far this year. Usually when new figures are released, they paint a pretty picture worthy of putting above the fireplace in that purchased new home. Recently, some numbers for the first quarter were adjusted to show a slight contraction in the economy. The initial response from Wall Street was unfavorable, but the correction itself is truly a mere blip. Nobody is predicting that the market will take a sudden turn.

Closed Sales decreased 4.4 percent for Detached homes but increased 3.3 percent for Attached homes. Pending Sales increased 22.0 percent for Detached homes and 33.5 percent for Attached homes. Inventory decreased 16.4 percent for Detached homes and 18.1 percent for Attached homes.

The Median Sales Price was up 7.1 percent to $530,000 for Detached homes and 6.1 percent to $348,000 for Attached homes. Days on Market decreased 9.5 percent for Detached homes and 13.5 percent for Attached homes. Supply decreased 21.2 percent for Detached homes and 21.4 percent for Attached homes.

One interesting effect of a weaker-than-expected economy is that the Federal Reserve does not seem ready to raise short-term interest rates during summer, as some had suggested might happen. New projections indicate that rates will remain the same until September at the earliest. The dominant storylines in housing are decidedly not negative these days. Instead, you’re more likely to see top sales and luxury living highlighted than the woes of foreclosures and short sales.

Residential real estate activity in San Diego County, comprised of single family properties, townhomes and condominiums. Percent changes are calculated using rounded figures.

Source: San Diego Association of REALTORS® – All data from Sandicor, Inc.