San Diego Real Estate Sales Activity for July 2015 Snapshot

- + 8.3% – One-Year Change in Pending Sales

- + 12.9% – One-Year Change in Closed Sales

- + 7.0% – One-Year Change in Median Sales Price

- – 20.4% – One-Year Change in Homes for Sale Inventory

- – 5.1% – One-Year Change in New Listings Inventory

The second half of the year is generally slower than the first, but the 2015 market as a whole has shown a willingness to offer greater returns more often than not. Prior to any autumn rate increases, there is a fair chance of increased buyer activity over the next few months. For the 12-month period spanning August 2014 through July 2015, Pending Sales in San Diego County were up 8.3 percent overall. The price range with the largest gain in sales was the $500,001 to $750,000 range, where they increased 22.9 percent.

Quick Facts

- + 22.9% – Price Range With Strongest Pending Sales: $500,001 to $750,000

- + 11.4% – Home Size With Strongest Pending Sales: 2,001 to 3,000 Sq Ft

- + 8.9% – Property Type With Strongest Pending Sales: Condos – Townhomes

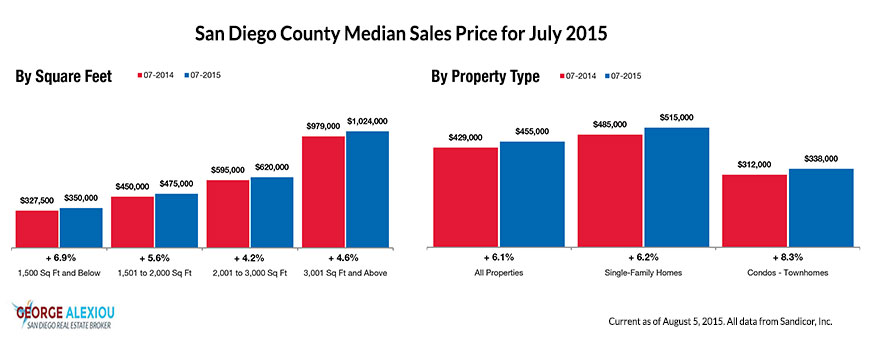

The overall Median Sales Price was up 6.1 percent to $455,000. The property type with the largest price gain was the Condos – Townhomes segment, where prices increased 8.3 percent to $338,000. The price range that tended to sell the quickest was the $500,001 to $750,000 range at 38 days; the price range that tended to sell the slowest was the $1,250,001 Or More range at 65 days.

Market-wide, inventory levels were down 20.4 percent. The property type that lost the least inventory was the Single-Family Homes segment, where it decreased 18.1 percent. That amounts to 2.8 months supply for Single-Family Homes and 2.2 months supply for Condos – Townhomes.

According to the U.S. Census, homeownership is at 63.4 percent for the second quarter of 2015, down 1.3 percent from the second quarter of 2014. This is the lowest rate of homeownership since 1967. To put that in greater context, homeownership peaked at 69.2 percent in 2004, and the 50-year average is 65.3 percent. Although the data may be indicating otherwise on a macro level, mortgage applications have kept REALTORS® busy through summer.

Closed Sales increased 12.2 percent for Detached homes and 14.3 percent for Attached homes. Pending Sales increased 18.8 percent for Detached homes and 29.9 percent for Attached homes. Inventory decreased 18.1 percent for Detached homes and 25.8 percent for Attached homes.

The Median Sales Price was up 8.8 percent to $555,000 for Detached homes and 4.9 percent to $341,000 for Attached homes. Days on Market decreased 14.6 percent for Detached homes and 8.1 percent for Attached homes. Supply decreased 24.3 percent for Detached homes and 33.3 percent for Attached homes.

Ever since the Great Recession ended in about June 2009, the market has strengthened to once again become a cornerstone of the national economy. Better lending standards, lower oil prices and higher wages are a few of the catalysts for positive change. Many trends continue to reveal a stable housing market. Federal Reserve Chair, Janet Yellen, has predicted a fine-tuning of monetary policy by the end of the year. It is widely believed that interest rates will go up before the year is over, an indicator that the housing market is ready for such a move.

Residential real estate activity in San Diego County, comprised of single family properties, townhomes and condominiums. Percent changes are calculated using rounded figures.

Source: San Diego Association of REALTORS® – All data from Sandicor, Inc.