San Diego Real Estate Sales Activity for December 2014 Snapshot

- – 6.1% – One-Year Change in Pending Sales

- – 11.0% – One-Year Change in Closed Sales

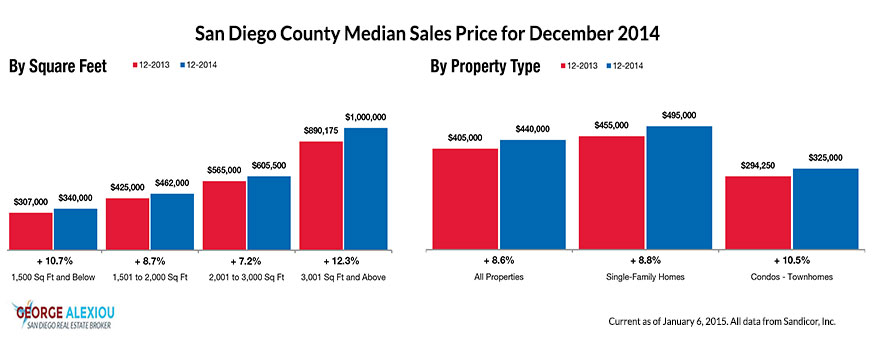

- + 8.6% – One-Year Change in Median Sales Price

- – 10.6% – One-Year Change in Homes for Sale Inventory

- – 2.3% – One-Year Change in New Listings Inventory

The 2014 numbers are in just in time for an annual review. Looking forward, 2015 offers much promise. Watch for price movement to come in line with historical norms, seller activity and inventory levels to increase, housing starts to gain momentum and for rates to remain attractive. For the 12-month period spanning January 2014 through December 2014, Pending Sales in San Diego County were down 6.1 percent overall. The price range with the largest gain in sales was the $500,001 to $750,000 range, where they increased 12.6 percent.

Quick Facts

- + 12.6% – Price Range With Strongest Pending Sales: $500,001 to $750,000

- – 2.4% – Home Size With Strongest Pending Sales: 1,501 Sq Ft to 2,000 Sq Ft

- – 4.1% – Property Type With Strongest Pending Sales: Condos – Townhomes

The overall Median Sales Price was up 8.6 percent to $440,000. The property type with the largest price gain was the Condos – Townhomes segment, where prices increased 10.5 percent to $325,000. The price range that tended to sell the quickest was the $500,001 to $750,000 range at 38 days; the price range that tended to sell the slowest was the $1,250,001 Or More range at 65 days.

Market-wide, inventory levels were down 10.6 percent. The property type that lost the least inventory was the Condos – Townhomes segment, where it decreased 8.6 percent. That amounts to 2.5 months supply for Single-Family Homes and 2.2 months supply for Condos – Townhomes.

It has been another recovery year in 2014 but not the same as 2013. With a broad pattern of rising prices and stable to improving inventory, the market has shifted from being drastically undersupplied to approaching equilibrium. Price gains are still positive but less robust than last year. The metrics to watch in 2015 include days on market, percent of list price received and absorption rates, as these can offer deeper and more meaningful insights into the future direction of housing.

Interest rates remained lower than anyone expected for the entire year. That trend snowballed with solid and accelerating private job growth to empower more consumers to buy homes. This coupled nicely on the governmental side with mortgage debt forgiveness and interest deduction preservation. Student loan debt, sluggish wage growth and a lack of sufficient mortgage liquidity still remain hurdles to greater recovery.

Residential real estate activity in San Diego County, comprised of single family properties, townhomes and condominiums. Percent changes are calculated using rounded figures.

Source: San Diego Association of REALTORS® – All data from Sandicor, Inc.