San Diego Real Estate Sales Activity for June 2014 Snapshot

- – 5.2% – One-Year Change in Pending Sales

- – 17.3% – One-Year Change in Closed Sales

- + 10.7% – One-Year Change in Median Sales Price

- – 1.0% – One-Year Change in Homes for Sale Inventory

- + 1.2% – One-Year Change in New Listings Inventory

The astute observer will note that headline figures can sometimes mask the truth. The truth hides within the various areas and sub-markets. Watch closely for signs of changing supply and demand dynamics in certain price ranges and other segments. For the 12-month period spanning July 2013 through June 2014, Pending Sales in San Diego County were down 7.8 percent overall. The price range with the largest gain in sales was the $1,000,001 to $1,250,000 range, where they increased 25.6 percent.

Quick Facts

- + 25.6% – Price Range With Strongest Pending Sales: $1,000,001 to $1,250,000

- – 4.3% – Home Size With Strongest Pending Sales: 1,501 Sq Ft to 2,000 Sq Ft

- – 2.4% – Property Type With Strongest Pending Sales: Condos – Townhomes

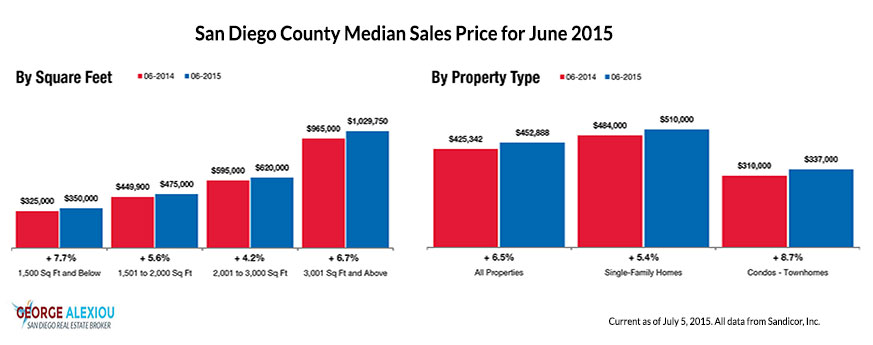

The overall Median Sales Price was up 14.8 percent to $426,000. The property type with the largest price gain was the Condos – Townhomes segment, where prices

increased 19.2 percent to $310,000. The price range that tended to sell the quickest was the $500,001 to $750,000 range at 36 days; the price range that tended to sell the slowest was the $1,250,001 Or More range at 68 days.

Market-wide, inventory levels were down 1.0 percent. The property type that gained the most inventory was the Single-Family Homes segment, where it increased 0.3

percent. That amounts to 3.3 months supply for Single-Family Homes and 2.7 months supply for Condos – Townhomes.

New Listings increased 1.2 percent to 4,733. Pending Sales were down 5.2 percent to 3,149. Inventory levels shrank 1.0 percent to 8,953 units.

Prices forged onward. The Median Sales Price increased 10.7 percent to $465,000. Days on Market was down 9.3 percent to 39 days. Absorption rates slowed as Months

Supply of Inventory was up 6.9 percent to 3.1 months.

Housing is one part of a broader ecosystem that thrives on a strong economy that churns out good jobs. First-quarter employment figures were adequate but not thrilling, but second-quarter numbers figure to be more positive. Access to mortgage capital remains an ongoing concern. As cash and investor deals fade, first-time buyers typically step to the forefront, but tight credit can and has been a real hurdle.

Residential real estate activity in San Diego County, comprised of single family properties, townhomes and condominiums. Percent changes are calculated using rounded figures.

Source: San Diego Association of REALTORS® – All data from Sandicor, Inc.