San Diego Real Estate Activity for May 2014

San Diego Real Estate Activity for May 2014 Snapshot

- – 6.6% – One-Year Change in Pending Sales

- – 7.3% – One-Year Change in Closed Sales

- + 16.4% – One-Year Change in Median Sales Price

- – 3.2% – One-Year Change in Homes for Sale Inventory

- + 2.0% – One-Year Change in New Listings Inventory

So how’s the market? We’ve all heard it, but it’s difficult to answer succinctly. The best answer may be “It depends.” It’s contingent upon area, market segment, time period,baseline period, which measures and more. For the 12-month period spanning June 2013 through May 2014, Pending Sales in San Diego County were down 6.6 percent overall. The price range with the largest gain in sales was the $1,000,001 to $1,250,000 range, where they increased 29.5 percent.

Quick Facts

- + 29.5% – Price Range With Strongest Pending Sales: $1,000,001 to $1,250,000

- – 3.0% – Home Size With Strongest Pending Sales: 1,500 Sq Ft and Below

- – 0.2% – Property Type With Strongest Pending Sales: Condos – Townhomes

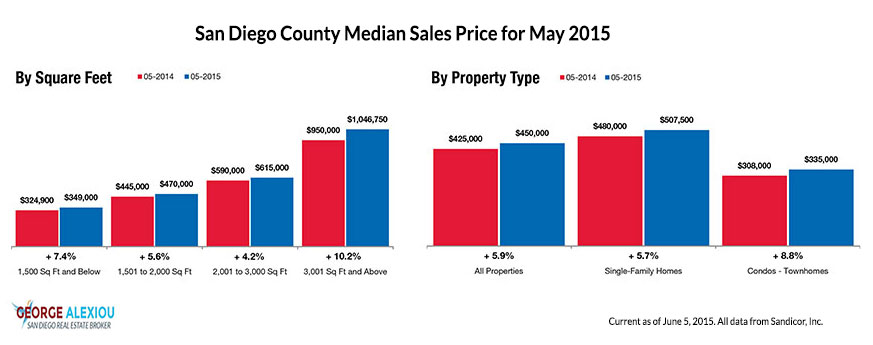

The overall Median Sales Price was up 16.4 percent to $425,000. The property type with the largest price gain was the Condos – Townhomes segment, where prices increased 22.4 percent to $308,400. The price range that tended to sell the quickest was the $500,001 to $750,000 range at 36 days; the price range that tended to sell the slowest was the $1,250,001 Or More range at 69 days.

Market-wide, inventory levels were down 3.2 percent to 8,359 units. The property type that lost the least inventory was the Single-Family Homes segment, where it decreased 3.1 percent. That amounts to 3.0 months supply for Single-Family Homes and 2.6 months supply for Condos – Townhomes.

We’ve had a mixed bag of economic news lately. As expected, national GDP contracted slightly during Q1-2014, which most economists attribute to impermanent factors like the harsh winter. We’ve now had more than four straight years of monthly private sector job growth. It hasn’t been extraordinary growth, but it sure beats mass layoffs. Buoyed by an improving sales mix, home prices continue their ascent despite erratic demand indicators. More inventory, more high-skilled job growth, and less economic and political uncertainty are still top priorities.

Residential real estate activity in San Diego County, comprised of single family properties, townhomes and condominiums. Percent changes are calculated using rounded figures.

Source: San Diego Association of REALTORS® – All data from Sandicor, Inc.