San Diego Real Estate Sales Activity for January 2015 Snapshot

- – 5.0% – One-Year Change in Pending Sales

- – 16.0% – One-Year Change in Closed Sales

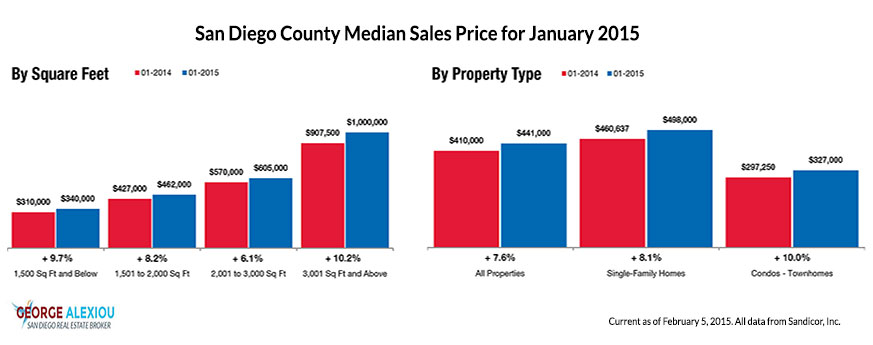

- + 10.0% – One-Year Change in Median Sales Price

- – 16.9% – One-Year Change in Homes for Sale Inventory

- – 7.9% – One-Year Change in New Listings Inventory

The prevailing trend for 2015 still appears to be more sales and rising prices – not of the headline-grabbing variety but enough to keep the wider economy bullish on housing. With improved inventory, things will only get better. For the 12-month period spanning February 2014 through January 2015, Pending Sales in San Diego County were down 5.0 percent overall. The price range with the largest gain in sales was the $500,001 to $750,000 range, where they increased 11.6 percent.

Quick Facts

- + 11.6% – Price Range With Strongest Pending Sales: $500,001 to $750,000

- – 0.7% – Home Size With Strongest Pending Sales: 1,501 Sq Ft to 2,000 Sq Ft

- – 4.0% – Property Type With Strongest Pending Sales: Condos – Townhomes

The overall Median Sales Price was up 7.6 percent to $441,000. The property type with the largest price gain was the Condos – Townhomes segment, where prices increased 10.0 percent to $327,000. The price range that tended to sell the quickest was the $500,001 to $750,000 range at 39 days; the price range that tended to sell the slowest was the $1,250,001 Or More range at 66 days.

Market-wide, inventory levels were down 16.9 percent. The property type that lost the least inventory was the Condos – Townhomes segment, where it decreased 16.7 percent. That amounts to 2.5 months supply for Single-Family Homes and 2.2 months supply for Condos – Townhomes.

It’s already evident that 2015 will be marked by talk of changing mortgage rates and regulations. Rates should stay low, but consumers and finance experts alike believe that we’re at or near rate bottoms. Early indications point to more sales, more listings, more new construction and more excitement. It’s not expected to be the overblown land grab of the early 2000s, but it should feel like a healthy market, which, in and of itself, may feel like an odd sensation to real estate practitioners accustomed to the boom and bust of the 21st century.

Closed Sales decreased 9.9 percent for Detached homes and 26.5 percent for Attached homes. Pending Sales increased 12.8 percent for Detached homes and 2.9 percent for Attached homes. Inventory decreased 16.9 percent for Detached homes and 16.7 percent for Attached homes.

The Median Sales Price was up 5.3 percent to $500,000 for Detached homes and 10.0 percent to $332,000 for Attached homes. Days on Market increased 2.0 percent for Detached homes but decreased 10.5 percent for Attached homes. Supply decreased 13.8 percent for Detached homes and 12.0 percent for Attached homes.

The 3 percent downpayment programs from Fannie Mae and Freddie Mac should help potential new homeowners, but in a recent member survey by the Independent Community Bankers of America, three-fourths of respondents stated that regulatory burdens are hurting their ability to loan money. The wider economy shows slight wage increases and gas prices near five-year lows but rising along with extended daylight and buyer demand. These various economic pushes and pulls can turn stagnant markets into exciting ones. It’s all in how you look at it.

Residential real estate activity in San Diego County, comprised of single family properties, townhomes and condominiums. Percent changes are calculated using rounded figures.

Source: San Diego Association of REALTORS® – All data from Sandicor, Inc.