San Diego Real Estate Sales Activity for August 2015 Snapshot

- + 9.7% – One-Year Change in Pending Sales

- + 5.9% – One-Year Change in Closed Sales

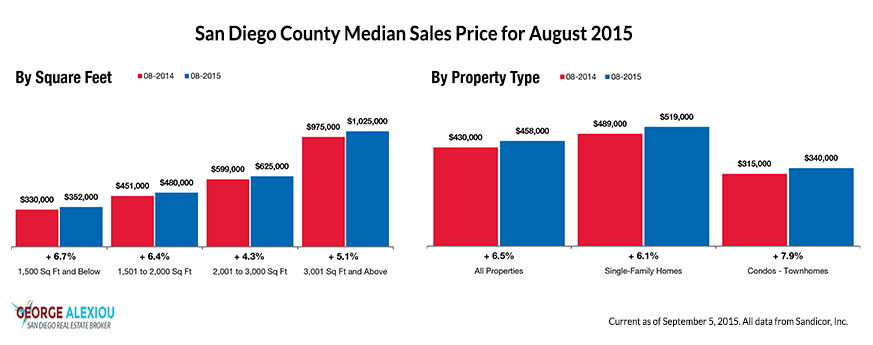

- + 6.5% – One-Year Change in Median Sales Price

- – 22.1% – One-Year Change in Homes for Sale Inventory

- – 5.5% – One-Year Change in New Listings Inventory

Like school busses in a darker dawn, the typical seasonal slowdown is imminent. Numbers may be a bit in flux, but no drastic year-over-year drops or rises are anticipated across most markets. For the 12-month period spanning September 2014 through August 2015, Pending Sales in San Diego County were up 9.7 percent overall. The price range with the largest gain in sales was the $500,001 to $750,000 range, where they increased 23.0 percent.

Quick Facts

- + 23.0% – Price Range With Strongest Pending Sales: $500,001 to $750,000

- + 12.1% – Home Size With Strongest Pending Sales: 2,001 to 3,000 Sq Ft

- + 1.01% – Property Type With Strongest Pending Sales: Condos – Townhomes

The overall Median Sales Price was up 6.5 percent to $458,000. The property type with the largest price gain was the Condos – Townhomes segment, where prices increased 7.9 percent to $340,000. The price range that tended to sell the quickest was the $500,001 to $750,000 range at 37 days; the price range that tended to sell the slowest was the $1,250,001 Or More range at 66 days.

Market-wide, inventory levels were down 22.1 percent. The property type that lost the least inventory was the Single-Family Homes segment, where it decreased 20.6 percent. That amounts to 2.8 months supply for Single-Family Homes and 2.2 months supply for Condos – Townhomes.

For many markets across the nation, home prices were up during summer in year-over-year comparisons. With the economy on full mend, the Federal Reserve Chair, Janet Yellen, has predicted a fine-tuning of monetary policy by the end of the year. In tandem with the improved economy, the unemployment rate for July 2015 remained at 5.3 percent for the second month in a row. It is widely believed that interest rates will go up before the year is over, which is something that generally does not happen without careful consideration for the impact such a move will have on residential real estate.

Closed Sales increased 2.1 percent for Detached homes and 8.9 percent for Attached homes. Pending Sales increased 18.4 percent for Detached homes and 22.5 percent for Attached homes. Inventory decreased 20.6 percent for Detached homes and 25.8 percent for Attached homes.

The Median Sales Price was up 7.7 percent to $540,000 for Detached homes and 2.9 percent to $350,000 for Attached homes. Days on Market decreased 23.3 percent for Detached homes and 12.8 percent for Attached homes. Supply decreased 26.3 percent for Detached homes and 31.3 percent for Attached homes.

According to statistics jointly released by the U.S. Census Bureau and the Department of Housing and Urban Development, privately-owned housing starts rose 0.2 percent when comparing July 2015 to the prior month and 10.1 percent when compared to July 2014. These numbers are at the highest levels the market has seen since October 2007. This bodes well for eventual potential buyers currently holding in a rental pattern or the wakening of those resting in extended parental basement hibernation. As ideal summer weather diverges toward autumn, we will begin to see some seasonal relaxation, but the market should still look positive when compared to last year.

Residential real estate activity in San Diego County, comprised of single family properties, townhomes and condominiums. Percent changes are calculated using rounded figures.

Source: San Diego Association of REALTORS® – All data from Sandicor, Inc.