San Diego Real Estate Sales Activity for November 2014 Snapshot

- + 10.7% – One-Year Change in Pending Sales

- – 19.5% – One-Year Change in Closed Sales

- + 6.0% – One-Year Change in Median Sales Price

- – 12.4% – One-Year Change in Homes for Sale Inventory

- – 4.2% – One-Year Change in New Listings Inventory

With the peak selling season behind us, current numbers show a normal seasonal slow-down in most market segments and neighborhoods. Metrics to watch include prices, inventory and demand indicators. For the 12-month period spanning December 2013 through November 2014, Pending Sales in San Diego County were down 7.3 percent overall. The price range with the largest gain in sales was the $1,000,001 to $1,250,000 range, where they increased 13.1 percent.

Quick Facts

- + 13.1% – Price Range With Strongest Pending Sales: $1,000,001 to $1,250,000

- – 3.6% – Home Size With Strongest Pending Sales: 1,501 Sq Ft to 2,000 Sq Ft

- – 4.6% – Property Type With Strongest Pending Sales: Condos – Townhomes

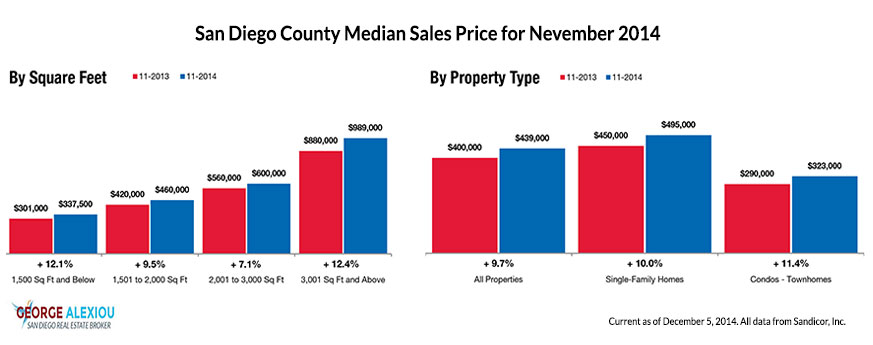

The overall Median Sales Price was up 9.8 percent to $439,000. The property type with the largest price gain was the Condos – Townhomes segment, where prices increased 11.4 percent to $323,000. The price range that tended to sell the quickest was the $500,001 to $750,000 range at 38 days; the price range that tended to sell the slowest was the $1,250,001 Or More range at 65 days.

Market-wide, inventory levels were down 12.4 percent. The property type that lost the least inventory was the Single-Family Homes segment, where it decreased 11.5 percent. That amounts to 3.0 months supply for Single-Family Homes and 2.5 months supply for Condos – Townhomes.

New Listings decreased 4.2 percent to 2,870. Pending Sales were up 10.7 percent to 2,555. Inventory levels shrank 12.4 percent to 8,077 units.

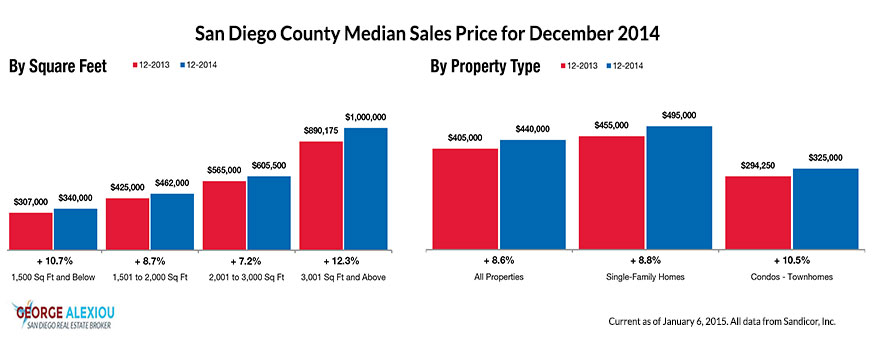

Prices continued to gain traction. The Median Sales Price increased 6.0 percent to $440,000. Days on Market was down 6.4 percent to 44 days. Sellers were encouraged as Months Supply of Inventory was down 3.3 percent to 2.9 months.

With 2015 near, some are pontificating about a potential change in interest rates. With virtually no inflation, rates will likely remain low for most of 2015 but could flirt with 5.0 percent toward the end of next year. Construction permits and housing starts have upward momentum, which is news in some areas but familiar in others. Prices should continue their ascent but at a tempered pace compared to recent years, which helps preserve affordability for first-time buyers.

It has largely been another recovery year in 2014, yet mortgage credit and student debt remain obstacles even as the U.S. leads the global economy toward recovery. As this recovery matures, many metrics are approaching a healthy balancing point. Rates have remained much lower than most forecasters expected, and inventory levels finally started rising in most areas as sellers generally listed more properties as a result of stronger prices. Job growth should continue and wage growth is expected to pick up.

Residential real estate activity in San Diego County, comprised of single family properties, townhomes and condominiums. Percent changes are calculated using rounded figures.

Source: San Diego Association of REALTORS® – All data from Sandicor, Inc.