San Diego Real Estate Sales Activity for February 2015 Snapshot

- – 3.7% – One-Year Change in Pending Sales

- – 5.8% – One-Year Change in Closed Sales

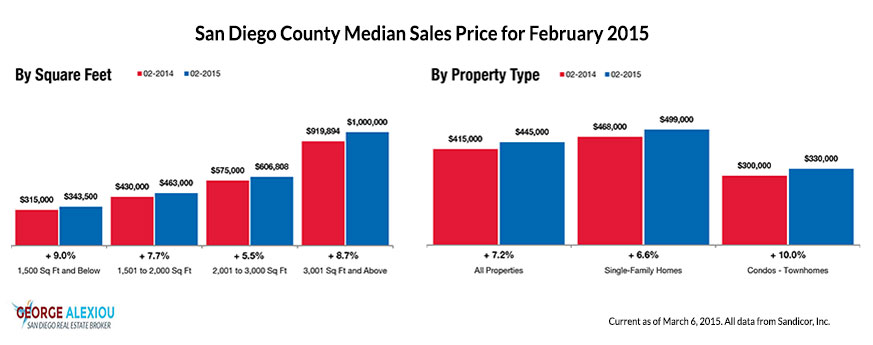

- + 7.2% – One-Year Change in Median Sales Price

- – 16.8% – One-Year Change in Homes for Sale Inventory

- 0.0% – One-Year Change in New Listings Inventory

For the 12-month period spanning March 2014 through February 2015, Closed Sales decreased 1.8 percent for Detached homes and 13.2 percent for Attached homes. Pending Sales increased 19.8 percent for Detached homes and 15.5 percent for Attached homes. Inventory decreased 16.1 percent for Detached homes and 18.4 percent for Attached homes.

Quick Facts

- + 12.4% – Price Range With Strongest Pending Sales: $500,001 to $750,000

- + 0.7% – Home Size With Strongest Pending Sales: 1,501 Sq Ft to 2,000 Sq Ft

- – 3.0% – Property Type With Strongest Pending Sales: Condos – Townhomes

The Median Sales Price was up 6.4 percent to $500,000 for Detached homes and 11.9 percent to $335,000 for Attached homes. Days on Market increased 6.0 percent for Detached homes but decreased 2.0 percent for Attached homes. Supply decreased 13.8 percent for Detached homes and 19.2 percent for Attached homes.

This is the year, folks. We should all be watching for more inventory compared to last year at various price segments to give hungry buyers something more to bite on. Rates are expected to remain low enough to be easy prey. For the 12-month period spanning March 2014 through February 2015, Pending Sales in San Diego County were down 3.7 percent overall. The price range with the largest gain in sales was the $500,001 to $750,000 range, where they increased 12.4 percent.

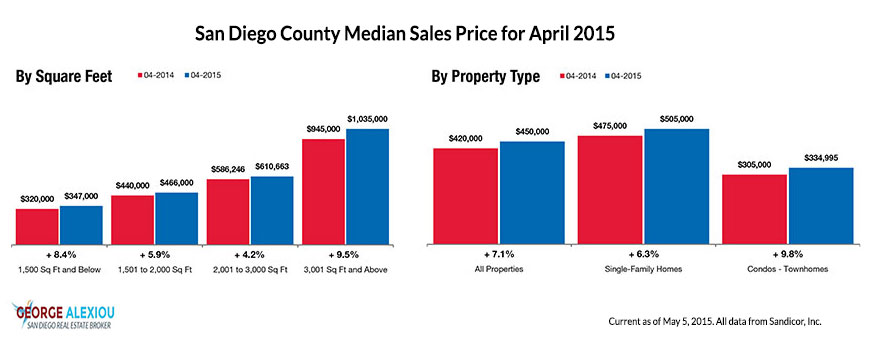

The overall Median Sales Price was up 7.2 percent to $445,000. The property type with the largest price gain was the Condos – Townhomes segment, where prices increased 10.0 percent to $330,000. The price range that tended to sell the quickest was the $500,001 to $750,000 range at 39 days; the price range that tended to sell the slowest was the $1,250,001 Or More range at 67 days.

Market-wide, inventory levels were down 16.8 percent. The property type that lost the least inventory was the Single-Family Homes segment, where it decreased 16.1 percent. That amounts to 2.5 months supply for Single-Family Homes and 2.1 months supply for Condos – Townhomes.

In national financial news, rumors that Fannie Mae and Freddie Mac could one day be a thing of the past have people wondering about the future of the 30-

year fixed-rate mortgage. But let’s not sound the alarm just yet. A drastic change to lending’s gold standard is certainly not on the immediate horizon.

Meanwhile, Federal Reserve Chair Janet Yellen seems to have no immediate interest in raising interest rates for the first time since 2006. The economy

remains stable, which should keep housing rolling through the short-named months.

Residential real estate activity in San Diego County, comprised of single family properties, townhomes and condominiums. Percent changes are calculated using rounded figures.

Source: San Diego Association of REALTORS® – All data from Sandicor, Inc.